Rockland County, NY Chapter 7 Bankruptcy Attorney

Liquidation Bankruptcy Lawyer Serving White Plains, Poughkeepsie, Manhattan, Brooklyn and Central Islip

When you are buried under a mountain of debt, the stress and anxiety can adversely impact every aspect of your life, including your job, family and health. Some people feel so overwhelmed that they bury their head in the sand and futility hope for a miracle. There is no reason to sit back and endure bank account levies, wage assignments, liens on real estate and/or foreclosures.

When drowning in this kind of debt, the incessant phone calls from collection agencies, stacks of threatening letters from creditors and service of creditor lawsuits can all end with a phone call to the Law Offices of Robert S. Lewis, P.C. Mr. Lewis has successfully guided hundreds of debtors through the bankruptcy process, so they could rebuild their financial future. He can guide you through every step of the process, which includes determining your best debt relief alternative, drafting the paperwork and representing you at hearings.

What Debts Can I Eliminate in a Chapter 7 Bankruptcy?

While the situation might appear bleak, Chapter 7 bankruptcy can provide a “fresh start” by eliminating most forms of unsecured debt for qualified debtors. When you file Chapter 7, you also receive the benefit of the “automatic stay”. This form of bankruptcy protection will enjoin most collection actions, so the harassing letters, annoying phone calls and creditor lawsuits will all stop while you are under the protection of the automatic stay. If you successfully complete the Chapter 7 bankruptcy process, the Chapter 7 bankruptcy discharge will eliminate the following types of unsecured debts:

- Credit card balances;

- Unpaid hospital bills;

- Personal loans not secured by collateral;

- Department store charge accounts; and

- Cell phone and utility bills.

Chapter 7 bankruptcy can extinguish the obligation to pay many unsecured debts. However, a Chapter 7 discharge does not impact the obligation to pay secured debts like mortgages or certain types of “priority unsecured debts,” including but not limited to the following:

- Alimony, child support, and certain other family court obligations;

- Most tax obligations;

- Fines and penalties imposed by a court; and

- Financial liability for drunk driving accidents.

Qualifying for a Chapter 7 Discharge – Means Test

While not every debtor will qualify for a Chapter 7 bankruptcy discharge, many debtors even with relatively high incomes still qualify under the Chapter 7 means test. If your income does not exceed the median income for New York based on the size of your household, you qualify under the means test.

If the debtor’s household income exceeds the median state income for a comparable sized family, a careful analysis of the debtor’s income and monthly secured and unsecured payments must be evaluated. If the debtor lacks sufficient “disposable income” after paying these debts and certain living expenses to make a significant payment toward unsecured non-priority obligations, the debtor qualifies for Chapter 7. The formula to determine if you qualify for Chapter 7 can be complicated, but the Law Offices of Robert S. Lewis, PC can analyze your income, assets and debts to determine your eligibility.

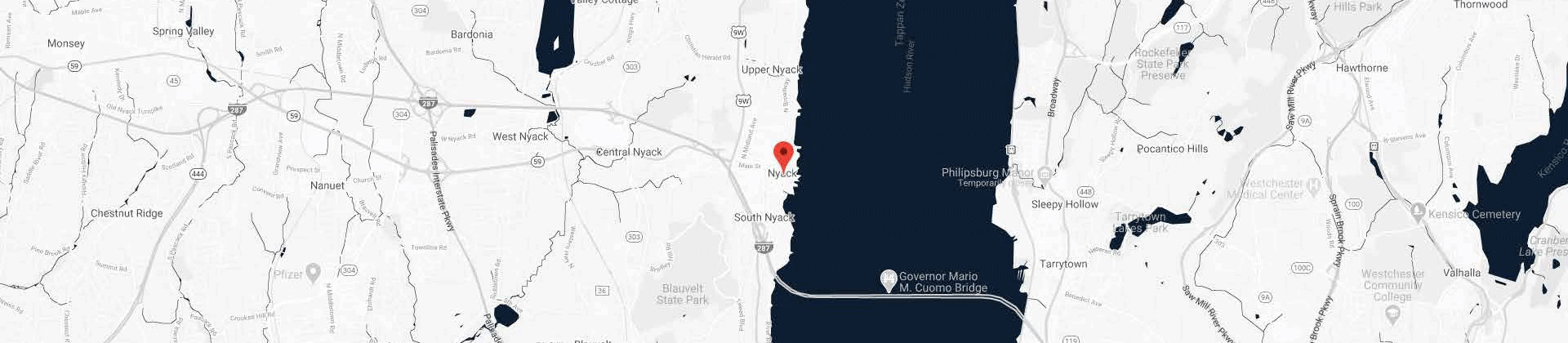

Rockland County bankruptcy attorney Robert S. Lewis has secured Chapter 7 bankruptcy discharges for hundreds of debtors. His 35 years of experience has equipped him to select the appropriate bankruptcy option to fit your situation, accurately complete the voluminous paperwork and represent you effectively in front of the bankruptcy trustee and/or bankruptcy court. If you are tired of screening your telephone calls and hiding when the doorbell rings, our New York bankruptcy law firm is prepared to help you reclaim control of your financial future. The Nyack, NY based Law Offices of Robert S. Lewis, P.C. represent clients throughout Rockland County. We invite you to contact us at 845-358-7100, so we can help you protect what you worked so hard to build. Se habla Español.