What Relief Can a Mortgage Loan Modification Provide?

Difficulty in keeping up with mortgage payments is a common problem, especially at a time when so many people are facing financial hardship related to the economic crisis caused by the coronavirus pandemic. If you are finding it more and more difficult to pay your mortgage, or if you have already missed payments, you may fear that you will inevitably lose your home to foreclosure. However, there are ways to prevent this from happening, one of the most common of which is applying for a loan modification.

How to Apply for a Loan Modification

If you know that you are likely to miss a mortgage payment, it may be possible to be proactive in contacting your lender about a loan modification. Alternatively, if you have already missed at least one payment, federal law may require your lender to initiate contact and inform you of loss mitigation options, one of which may be loan modification. In either case, you will need to submit an application explaining the reasons for your financial hardship, such as the involuntary loss of your job, the effects of an illness, or the loss of an income provider in your household.

Depending on your lender and the circumstances of your case, it may be possible to modify the terms of your loan in a few different ways. For example, you could:

-

Extend the length of time to repay your loan. If, for example, your original loan included a payback period of 30 years, you could extend it to 40 or 50 years, thereby reducing the amount that you must repay each month. This does allow interest to accumulate over a longer period of time, meaning that the total amount you pay over time is greater, but it can provide significant relief in the short term.

-

Change to a fixed-rate loan. If you have a mortgage with an adjustable interest rate, you may have reached the point where the rate has increased to a level that is no longer sustainable for you. If so, converting to a fixed rate can prevent your monthly payments from rising further and allow you to better plan to fulfill them.

-

Lower your interest rate. If you already have a fixed-rate mortgage, a loan modification could help you reduce the rate, along with your monthly payment, in the short term. With this option, you may need to prepare for the rate to increase in the future.

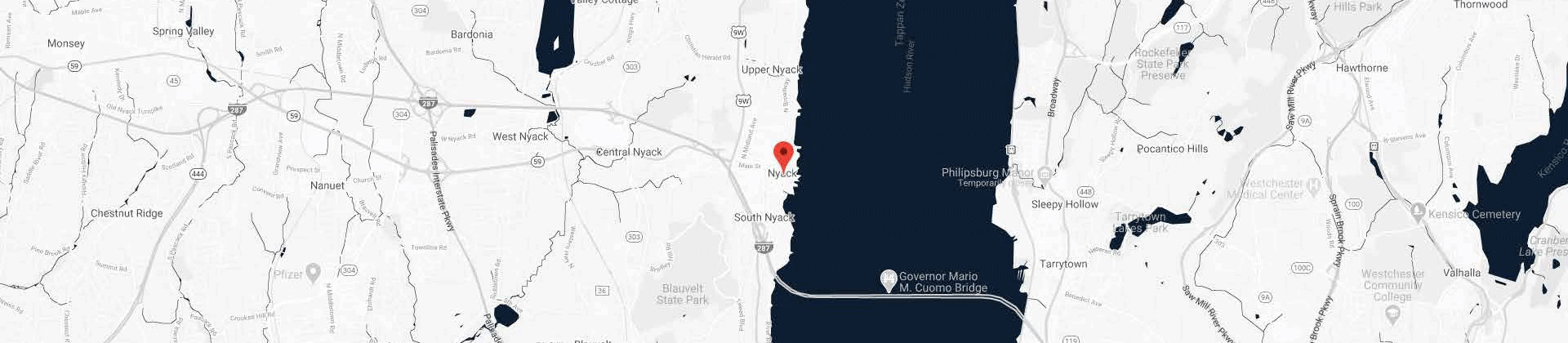

Contact a Hudson Valley Area Loan Modification Attorney

A knowledgeable attorney can help you follow the required procedure for applying for a loan modification, prepare information to demonstrate your need, and negotiate on your behalf to help you achieve the most advantageous terms in your modification. To schedule a free initial consultation with our skilled Rockland County foreclosure defense lawyer, call the Law Offices of Robert S. Lewis, P.C. today at 845-358-7100.

Sources:

https://www.law.cornell.edu/cfr/text/12/1024.39

https://loans.usnews.com/articles/what-is-loan-modification

https://www.investopedia.com/terms/l/loan_modification.asp