New Year, New Start: Life After Bankruptcy in New York

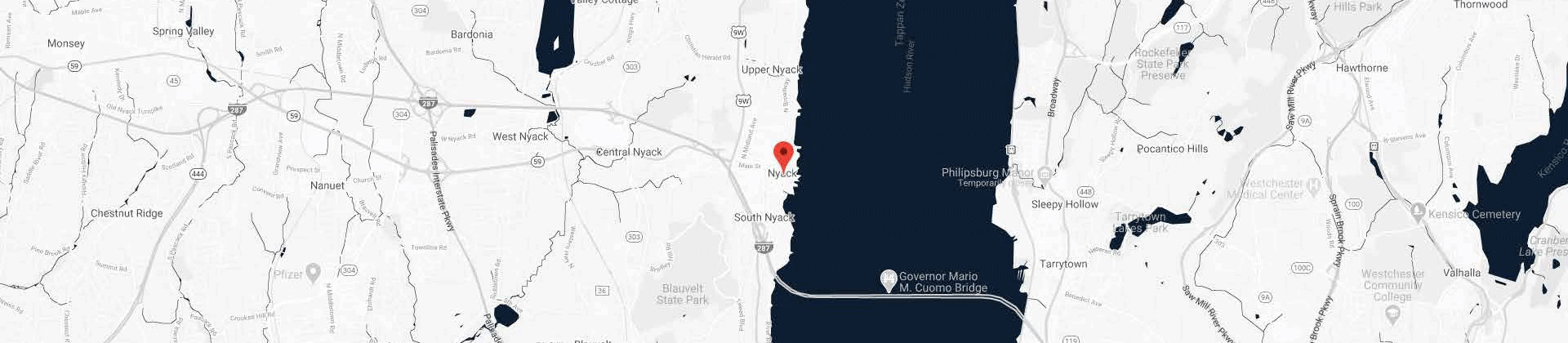

Rockland County Bankruptcy Law Firm

Filing for bankruptcy changes your life. As you know if you recently filed for Chapter 7 or Chapter 13 bankruptcy, filing for bankruptcy takes a toll on your credit score, your financial well being, and your emotional health.

But having to file for bankruptcy is not the end of the world. In fact, it’s quite the opposite. Bankruptcy is your opportunity to regain control of your finances and redirect yourself and your money toward a better future. Although the process of working out your bankruptcy and repaying your debts, either through liquidation for Chapter 7 or a repayment plan for Chapter 13, can be stressful, you can find solace and confidence following your bankruptcy by following the following steps.

Create a Budget

You need somewhere to live, you need to eat, and you need to get yourself to work. Keeping these in mind, write up a monthly budget that allows you to meet all your expenses without depleting that month’s income. A financial planner can help you with this if you are not familiar with budgeting. Creating a workable budget might mean curbing or even eliminating certain expenses, such as cable television or nights out. Get your budget on track by spending only what you need to spend and putting any leftover money into savings.

Get a Credit Card

This might sound counterintuitive, but getting a new credit card and paying its balance off in full every month is one of the best ways to prove to creditors that you are responsible enough to maintain a line of credit and on your way to financial recovery. If you cannot obtain an unsecured credit card, get a secured credit card.

A secured credit card requires a cash deposit to open. The amount of the cash deposit is the card’s credit limit. The creditor holds this cash and if the card is closed, it is returned to the card holder. Secured credit cards are a popular option for individuals looking to rebuild their credit after bankruptcy and young adults looking to begin building credit. You cannot rebuild your credit without actively working to do so – obtaining a new credit card, whether secured or unsecured, is one of the most efficient ways to do so.

Educate Yourself

There’s a lot of information out there about bankruptcy. Not all of it is true.

You might have been told that you cannot qualify for a mortgage for 10 years or longer after filing for bankruptcy. This is absolutely false. Not only can you qualify for a home loan after filing for bankruptcy, you can obtain an FHA home loan during a Chapter 13 proceeding.

Before you file for bankruptcy, familiarize yourself with New York’s bankruptcy exemptions. If you file for Chapter 7, you will need to know which property of yours may be liquidated to repay your creditors.

Learn the differences between Chapter 7 and Chapter 13 bankruptcy and how each type can affect you and your finances. You will learn more about these in credit counseling, which is required for all New Yorkers considering filing for bankruptcy.

Forgive Yourself and Focus on the Future

It does not matter how you reached the point of being unable to pay back your debt – once you file for bankruptcy, you are on your way to recovery. Thirteen percent of adults in the United States say they have considered filing for bankruptcy. That is one in eight adults in this country. You are not alone. The difference between moving past your financial hardships and remaining stuck in self-destructive habits is your attitude. Embrace your opportunity to forge ahead with a clean slate, and remember: there are resources available for you if you ever feel you need support or advice for life after bankruptcy.

Contact An Experienced Nyack Bankruptcy Attorney

The Law Offices of Robert S. Lewis, P.C. is here to help guide you through the often difficult, confusing process of filing for bankruptcy. Contact an experienced Nyack bankruptcy attorney today at 845-358-7100 to discuss your case with us during your free legal consultation. Remember, you are not alone. Bankruptcy is your opportunity to reassess your finances and start moving toward a more fiscally sustainable future.