Rockland County Chapter 13 Bankruptcy Attorney

Protect Your Home and Other Non-Exempt Assets

While many people associate the term “bankruptcy” with Chapter 7, there are situations where a repayment plan under Chapter 13 provides a more appropriate debt relief solution. If you are behind on your mortgage and you have significant home equity, or you cannot qualify for Chapter 7 under the means test, Chapter 13 can provide relief from foreclosure, wage assignments and lawsuits.

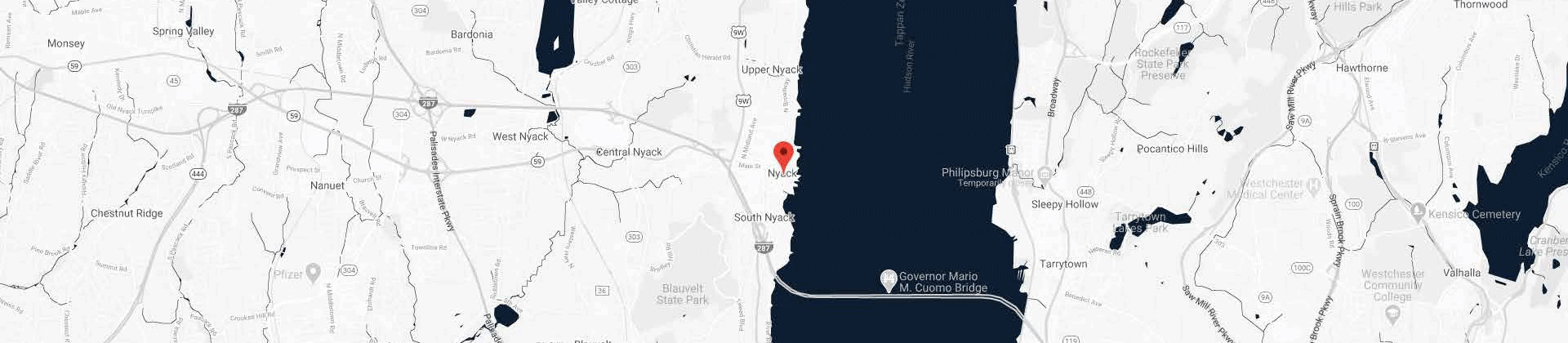

Nyack, New York Chapter 13 attorney Robert S. Lewis has over 35 years of legal experience, which includes obtaining bankruptcy relief for hundreds of debtors. Because he had been handling bankruptcies for decades, he can provide sound counsel on whether you should seek Chapter 7 or Chapter 13 and guide you through the process from the initial filing to your bankruptcy discharge.

What Defines Bankruptcy Under Chapter 13?

Chapter 7 bankruptcy involves liquidating a debtor’s assets (at least in theory) to pay creditors. Under Chapter 13, debtors keep all of their assets provided they continue making payment on secured debts like their mortgage or car as they come due. Under Chapter 13, the debtor develops a three or five-year payment plan rather than simply having all of the debtors unsecured non-priority debts discharged. The plan will include the following:

- Payment on arrears for secured debts;

- Payment on arrearages on unsecured priority debts like child support; and

- A portion or all of amounts owed on credit cards and other non-priority unsecured debts.

These obligations are paid through a three or five-year payment plan. The debtor makes payments each month to the U.S. Bankruptcy Trustee, who in turn distributes the amounts designated in the plan to the listed creditors. In addition to making this payment each month, the debtor also needs to keep his or her mortgage, car note and other secured obligations current as they come due. At the end of a Chapter 13, the debtor receives a discharge similar to a Chapter 7, which will extinguish any remaining balances on unsecured non-priority debts (e.g. credit cards, hospital bills, etc.).

When Does Chapter 13 Provide the Right Debt Relief Solution?

Chapter 13 can be a more appropriate alternative for debtors even though it will not result in a discharge from most or all unsecured debts like Chapter 7. Some common situations where Chapter 13 is more appropriate include:

- Debtors with substantial assets that cannot be protected by exemptions;

- Homeowners with equity that exceeds their homestead exemption;

- Individuals facing non-dischargeable debts like child support, alimony arrearages and other priority unsecured debts;

- Applicants ineligible for Chapter 7 under the means test; and

- Debtors who are barred by Chapter 7 because insufficient time has passed since a prior discharge.

If you are behind on financial obligations with little hope of catching up, Chapter 13 bankruptcy might be a viable option for you. The Nyack, NY based Law Offices of Robert S. Lewis, P.C. have successfully assisted many consumers just like you in protecting their property, neutralizing onerous collection practices and avoiding foreclosure. Even if your residence is currently scheduled for a foreclosure sale, you might be able to save your home. However, time is of the essence, so contact Rockland County Chapter 13 attorney Robert S. Lewis today to see how he can help at 845-358-7100.