How Is Spousal Support Calculated in New York Divorce Cases?

When couples in New York divorce, the issue of spousal support may arise. Spousal support, which is also known as alimony or spousal maintenance, is a payment from one spouse to the other that will provide a spouse who earns a lower income with the necessary support to meet their needs. In some cases, spousal support may be ordered by the court as part of a divorce judgment. In other cases, the parties may agree to spousal support terms in their divorce settlement. Whether you are seeking spousal support or are facing the prospect of paying it, it is important to understand how spousal support is calculated in New York.

When couples in New York divorce, the issue of spousal support may arise. Spousal support, which is also known as alimony or spousal maintenance, is a payment from one spouse to the other that will provide a spouse who earns a lower income with the necessary support to meet their needs. In some cases, spousal support may be ordered by the court as part of a divorce judgment. In other cases, the parties may agree to spousal support terms in their divorce settlement. Whether you are seeking spousal support or are facing the prospect of paying it, it is important to understand how spousal support is calculated in New York.

Calculating the Amount of Spousal Support Payments

New York courts will use different calculations for spousal support depending on whether child support will be a factor in a couple’s divorce. In cases where a non-custodial parent will be paying both child support and spousal support, the amount of payments will be determined by taking 20 percent of the payor’s income and subtracting 25 percent of the payee’s income. For example, if the payor earns $100,000 per year, and the payee earns $50,000 per year, spousal support would be calculated by subtracting $12,500 ($50,000 x .25) from $20,000 ($100,000 x .2), for a total of $7,500. Since spousal support is usually paid monthly, this amount would be divided into 12 payments of $625.

In cases where child support is not a factor or when the custodial parent will be paying spousal support to the other spouse, the amount of payments will be determined by taking 30 percent of the payor’s income and subtracting 20 percent of the payee’s income. Using the example above, spousal support would be calculated by subtracting $10,000 ($50,000 x .20) from $30,000 ($100,000 x .3), for a total of $20,000.

There are limits on the amount that a person can receive based on a couple’s combined income. 40 percent of the sum of both parties’ incomes will be calculated, and the payee’s income will be subtracted from this amount. If the total is less than the amount of spousal support determined using the calculations above, this will be the amount of support the payee will receive. In the example above, 40 percent of the couple’s combined income is $60,000 ($150,000 x .4), and subtracting the payee’s income from this amount results in $10,000. Thus, in situations where the payor will also be paying child support, the annual amount of spousal support will be $7,500, and in other situations, spousal support will be limited to $10,000 per year (or monthly payments of $833.33).

New York law states that the amount of spousal support that will be paid will be calculated prior to determining the amount of child support payments. This will ensure that parents’ incomes used in these calculations will reflect the financial resources available to them each month. If the requirement to pay spousal support would reduce a person’s income below the annual “self-support reserve” amount (which is $18,347 in 2022), the amount of payments may be reduced to the difference between their income and the self-support reserve. On the other hand, if the payor’s income is above an amount known as the “income cap” (which is $203,000 in 2022), the spousal support calculations will only apply to income up to this amount, and a judge will have the discretion to determine how to calculate spousal support for income that exceeds the income cap.

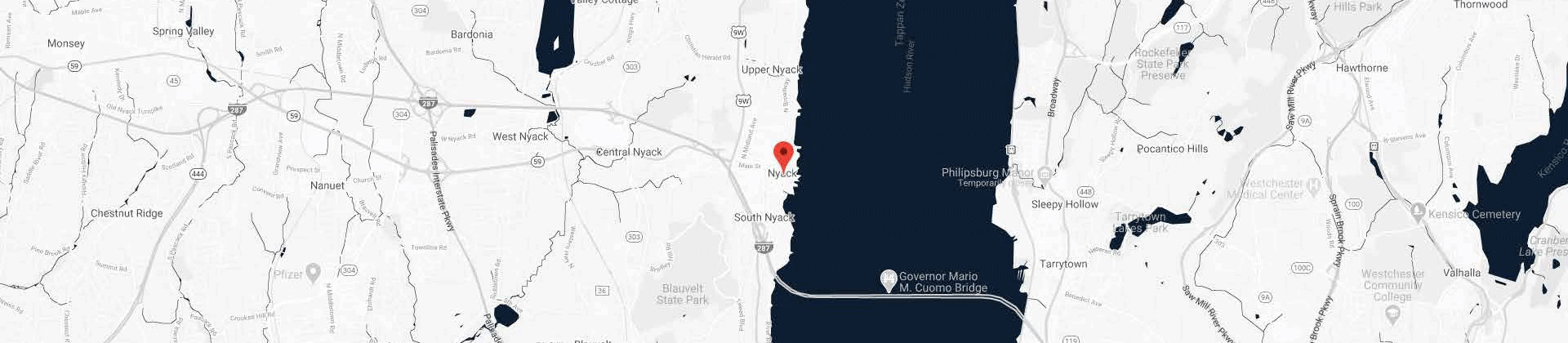

Contact Our Hudson Valley Spousal Support Attorney

If you are facing a divorce and need assistance with spousal support, it is important to work with an experienced attorney. At Law Offices of Robert S. Lewis, P.C., we can provide guidance on whether spousal support is appropriate in your case and how much you may be entitled to receive or be required to pay. We will represent your interests in court and make sure you will have the financial resources you need to support yourself once your marriage has ended. Contact our Rockland County spousal maintenance lawyer today at 845-358-7100 to set up a free consultation.

Sources:

https://www.nycla.org/PDF/probono/092016/Appendix%20G.pdf

https://www.nycourts.gov/LegacyPDFS/divorce/Calculator.pdf

https://www.childsupport.ny.gov/dcse/pdfs/CSSA.pdf